Shares of INFN if you were holding this from over the weekend. We had purchased it at $23.33 on Friday and we had gotten out of half of it with a $.67 gain. We raised our stop up to $23.98, and that’s where we got stopped out of it today for a gain on the balance of $.65 a share.

It was a decent trade and it’s getting a little extended. This is a difficult market environment. We have all kinds of mixed messages on different time frames as we mentioned, so we have to continue to go slow here unfortunately. That’s just the message of the market and we can’t change it as much as we want something different –

The market is not going to bend to our will.

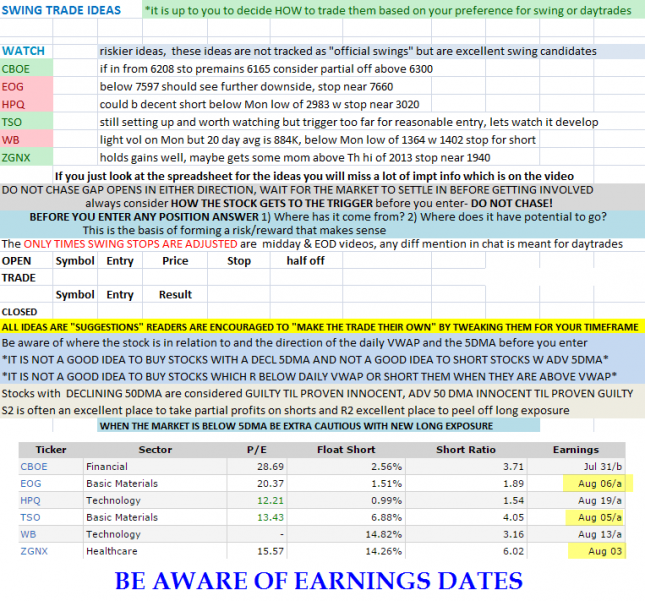

Shares of CBOE, if you got involved in here today on the secondary entry at 62.08, we had our stop at 61.65 and I think that’s the best place to continue to keep that stop, if you wanted it tighter perhaps 61.95’ish. The official stop that we’ll track is 61.65.

Shares of NEO, might of wanted to hold but failed. A loss of 14 cents a share was realized on lighter volume.

Shares of EOG, an energy stock (which I strongly dislike), is clearly broken but had a little rally. The 5 day moving average is advancing however…

Watch the video for the full analysis and new stock trading ideas of 8/4/2015.